Save taxes with modernization and maintenance

Improved depreciation opportunities through modernization in the four redevelopment areas: "Central station and Burtscheid, Beverau, Haaren and city center"

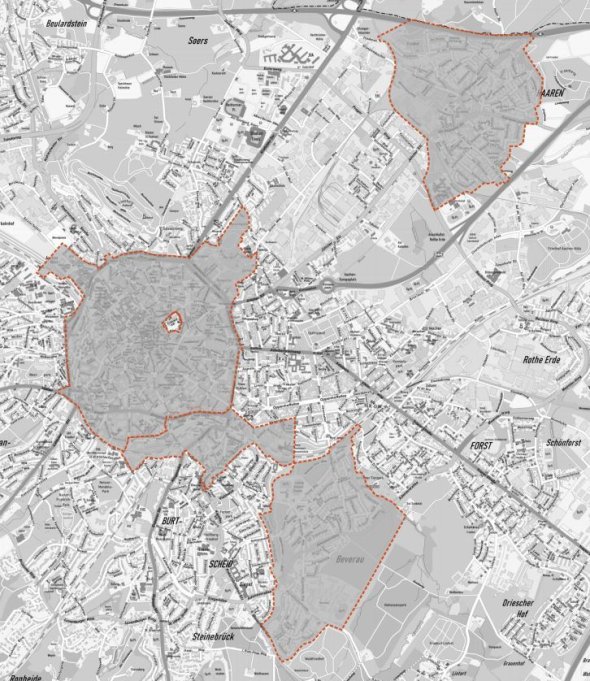

Are you an apartment or house owner? Would you like to modernize, renovate or repair your existing property? Is your residential property located in an Aachen redevelopment area, for example the main train station and Burtscheid, Beverau, Haaren or in the city center? In this case, you may be able to save on taxes - even if you use the building for your own residential purposes. Here you will find tips and suggestions that you should discuss with your tax advisor.

Investing in living space makes sense. After all, modernization has been proven to save money by reducing energy costs through improved insulation and more efficient technology. Those who modernize can also save money through improved deductibility, as the legislator provides tax incentives for modernization, renovation and repair. And by the way, those who modernize are also acting in an environmentally friendly and sustainable manner.

Sections 7h (increased deductions), 10f (tax concessions for own residential purposes) and 11a (special treatment of maintenance costs) of the Income Tax Act allow structural measures on buildings or architectural monuments in designated redevelopment areas and urban development areas to be tax-privileged under certain conditions.

This is about

- increased deductions for production and acquisition costs (up to nine percent in the year in which the measures are completed and in each of the following seven years, and up to seven percent in each of the following four years),

- the possibility of deduction as special expenses (ten years at up to nine percent each) if the building is used for own residential purposes, and

- Maintenance expenses that can be spread evenly over two to five years for tax purposes.

Modernization refers to the elimination of defects in order to adapt the building to today's healthy living and working conditions, e.g. by installing a bathroom or new windows. Repair, on the other hand, means the elimination of defects so that the building can be used as intended - e.g. the replacement of defective components. Maintenance, on the other hand, refers to the ongoing preservation of the value of a building. The Income Tax Act contains various regulations in this context, which can only be summarized here.

The City of Aachen cannot accept any liability for completeness and correctness in terms of tax law. Please consult your tax advisor. Irrespective of this, the regulations on modernization in tenancy law or according to the Building Code must be observed (keyword modernization levy, change of use). Renovation advice is offered by altbau plus e.V.

Many costs are offset - modernization agreement is a prerequisite

There are several prerequisites for using the improved depreciation options. First of all, it is necessary to coordinate with the specialist office before starting the refurbishment in order to coordinate planned and deductible measures. This is because not all expenses planned by the owner may fall under the definition of modernization within the meaning of the German Building Code (see § 177 BauGB). Conversions are particularly critical - for example, the conversion of an attic that was previously not used for residential purposes.

Once all measures, their estimated costs and other necessary documents have been collected, the modernization agreement is concluded in the form of a contract.

The agreed measures should now be implemented within the implementation period of the statutes or within a maximum of five years. If there is a need for changes in planning or implementation, please contact the specialist department at the City of Aachen in good time. The contract may then have to be amended.

Once the modernization, refurbishment or repair work has been completed, submit a written application for a modernization certificate. This is for submission to the tax office. In addition to a special form, you will need the plans of the existing building, the plans with entry of the measures, the agreement, a list of the total costs (in an Excel file for electronic transmission), original invoices and photo documentation (before and after).

The City of Aachen then examines the following points:

- Is the building located in a designated redevelopment area?

- Are or have modernization and repair measures or measures within the meaning of Section 7h (1) sentence 2 (buildings of historical, artistic or urban significance) been carried out?

- In what amount have expenses been incurred?

- Have public subsidies from urban development funds been granted or will be granted after the certificate has been issued?

Fees for architects and engineers, ancillary building costs, approval and inspection fees can also be recognized. In most cases, new buildings as defined by tax law (e.g. first-time living space), sewer connection fees, expenses for a second bathroom, sauna, bar or swimming pool, awnings, interior or replacement costs for parking spaces are not eligible. Please refer to the supplementary information sheet.

If the assessment is positive, you will receive a certificate in accordance with the certification guidelines for submission to the tax office. The City of Aachen certifies that the measure has been carried out, that the costs have been verified and that the measure complies with the objectives and purposes of urban redevelopment. Furthermore, this is not a disbursable funding measure.

The tax authorities, in turn, are responsible for checking the other tax requirements. It is therefore recommended that you contact the relevant tax office in good time in order to obtain binding information.

Important: The modernization agreement must be concluded before the start of construction!

The modernization and repair contract is subject to a fee. The amount of the fee depends on the amount to be certified and is as follows

- 1.00 percent of the expenses to be certified up to 250,000 euros

- 0.50% of the expenses to be certified over 250,000 euros up to 500,000 euros

- 0.25 percent of the expenses to be certified over EUR 500,000 with a maximum fee amount of no more than EUR 25,000 in total.

The certificate for submission to the tax office is free of charge and is issued in the form of a basic assessment notice.